What Are the Key Factors to Watch Out as We Enter 2024?

As we move into the new year 2024 and make some new year resolutions, here’s something of interest in the Bhagavad Gita - The sixth chapter of the Bhagavad Gita is known as “Dhyaana Yoga”.

Meditation is a topic that fascinates everyone. We like the idea of going to a retreat, away from all our troubles, and sitting in a tranquil place to meditate. But in this chapter, Shri Krishna has a unique viewpoint about the process of meditation and who is a meditator. He first says that only one who is engaged in the expression of his desires through Karma Yoga, through the performance of Svadharma, is a good meditator. In other words, Shri Krishna says that one does not have to give up their household duties for pursuing meditation. Second, one does not have to physically renounce action and retire to a monastery to meditate. The culmination of Karma Yoga is the loss of a sense of doership. This is the qualification of a meditator.

In the rest of this chapter, he covers all aspects of meditation including: What is meditation? What is the process? What we have to do internally and externally? What are the obstacles and how do we remove them? and How does such an individual that is established in meditation live in this world and many such interesting things? A very beautiful and practical chapter indeed.

With that, we wish all our readers, friends, family, and investors a very happy, prosperous, joyful and healthy 2024 and move on to our discussion on the markets.

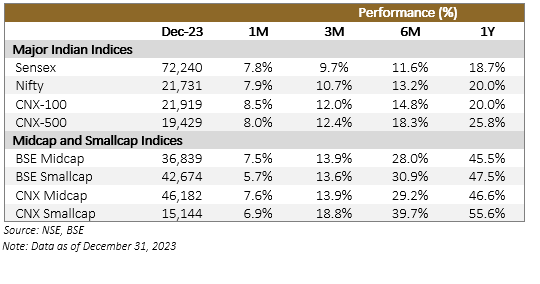

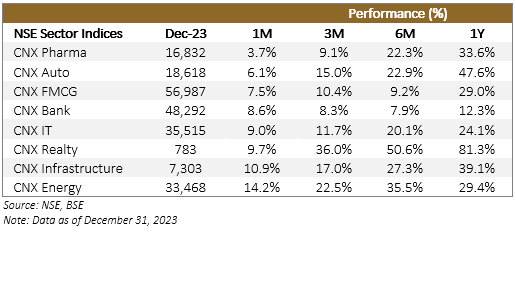

2023 was a year of surprises! US recession was the most spoken about and it never came. The hot favourite trade of China opening up turned out to be too short lived. However, the benchmark Nifty 50 has surged by nearly 20%, Nifty Smallcap 100 index surged ~50%, while the Nifty Midcap 100 jumped over ~45% in 2023. India’s market capitalisation crossed the USD 4 trillion mark. The Indian stock market is ranked fourth in the world in terms of market capitalisation, following the United States, China and Japan.

The World is hopeful for better in 2024. Here’s a discussion on all that to look out for in 2024.

Elections

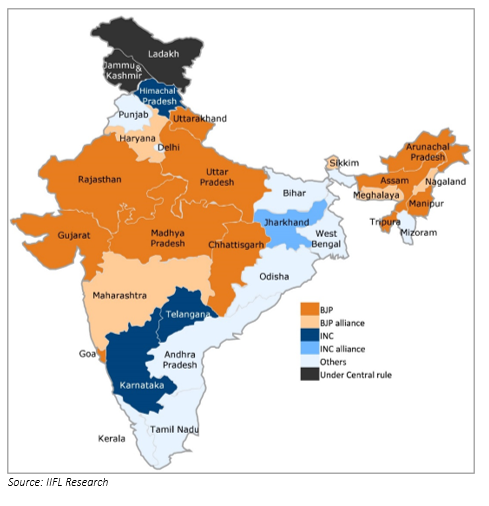

Of the five states that went to polls, BJP posted a clear majority in Madhya Pradesh (incumbent), Rajasthan and Chhattisgarh, while Congress bagged Telangana. BJP currently has governments in 16 states (11 on its own and 5 in alliance), 4 states for Congress.

As such, we do not see the recent state election results having any direct bearing on the 2024 General Elections, as the electorate tends to vote differently in the centre and state elections. However, it has helped the BJP set a narrative in its favour. If the BJP wins with a majority in the central elections, it would be seen as a long-term positive as investors prefer stability as policy initiatives and investment environment would continue unabated.

2024 is expected to be a year of global elections, national elections in more than 40 countries, including seven major economies. Taiwan, Indonesia, South Africa, and Mexico are other emerging markets with elections in the first half of 2024. The US election is scheduled for November 2024, while the UK election is likely to occur in January 2025.

Rate Cuts

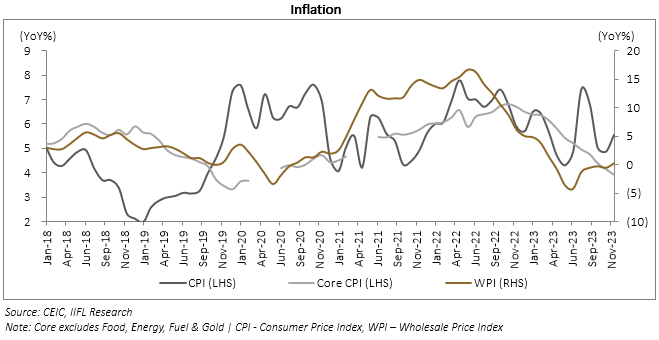

Core inflation has fallen from above 6% (RBI’s upper tolerance bound) to around 4% currently (mid-point). Food inflation remains volatile. RBI is on pause mode, with the policy rate at 6.5% broadly in line with pre-COVID levels. We may see RBI pivoting to monetary easing along with other developed markets central banks. The Fed has projected 75 bps of rate cuts in 2024 and 100 bps in 2025 which implies the global rate cycle is turning.

The rally in the US and key global markets in the last two months of 2023 was fuelled by a rising belief, following Fed commentary, that central banks around the world will cut interest rates significantly in 2024 as the impact of the recent sharp tightening cycle on growth and employment will be manageable.

Oil Prices

We could see tussles increasing over the green energy transition. While the transition itself is fledgling, a complex rivalry is shaping up between the two big US energy companies, ExxonMobil and Chevron, and the world’s preeminent oil cartel, OPEC+, dominated by Saudi Arabia and Russia.

“The great rebalancing”: The two US companies recently went out shopping, spending USD 124 billion to consolidate oil production in the western hemisphere. Consolidation is continuing with energy company APA striking a USD 4.5 billion deal to buy Callon Petroleum. Big oil enters 2024 strengthened by U.S. industry consolidation | Reuters

The US and Canada produced more oil and gas than all of West Asia combined in 2023. This enormous capacity gives them the power to blunt any aggressive moves by OPEC+ to dial up or down production to protect global prices.

Such competition is good for heavy energy importers such as India as it will likely bring stability to prices.

FII Flows

A perfect soft landing is becoming a near-consensus view among market participants. This will need monthly confirmations of continued cool-off in inflation and a gradual rise in unemployment. If confirmed, the US dollar should decline as global risk appetite picks up. Historically, a weaker US dollar has fuelled emerging markets inflows.

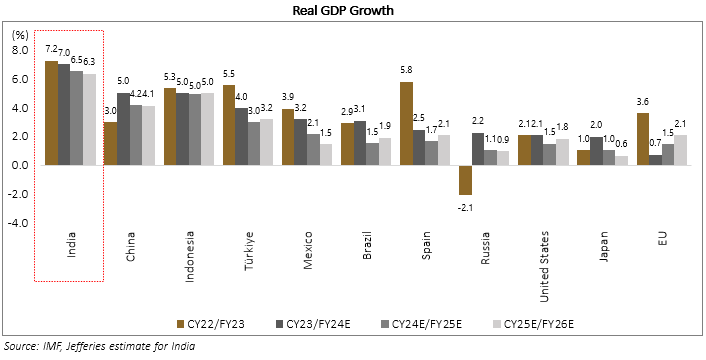

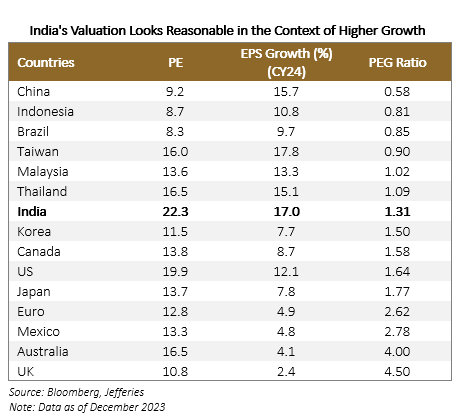

The international macro looks weak with major economies either slowing (US, China) or already contracting (EU). With India’s growth momentum, it is likely to be relatively strong vs other major economies.

Earnings Growth

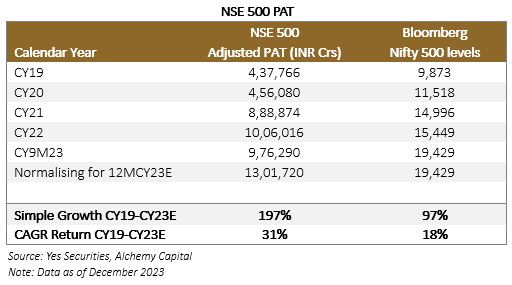

The earnings growth of NSE 500 has been outpacing the Nifty 500 returns. While the NSE 500 PAT has increased by 31% CAGR since CY19 end to CY23E (normalising actual PAT numbers for 9MCY23 for a full year), the Nifty 500 has only moved about 18% CAGR, we expect the earnings momentum to continue.

Capex Cycle

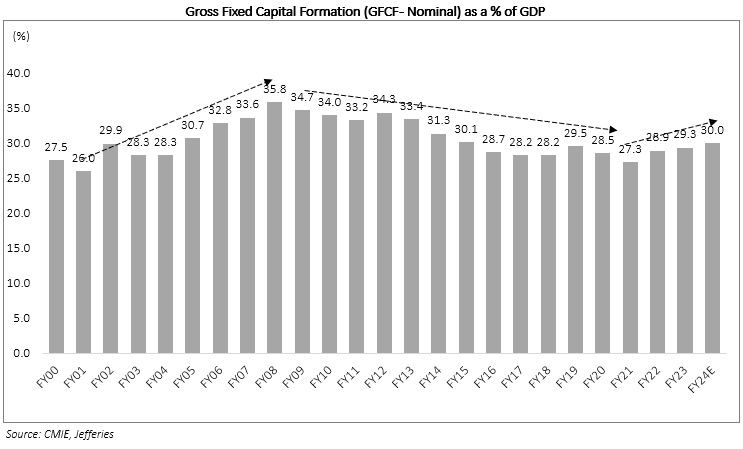

Gross Fixed Capital Formation (GFCF) as a proportion of GDP touched a multi-year high of 35% in 1HFY24, led by government capex which rose 25% YoY. Capacity utilisation, as measured by the RBI, is now inching above its long-term average and private players are getting ready to make a bigger push on capex. A strong balance sheet and government incentives, like the PLI scheme, and supply-side reforms, like the low tax rate, are already in place to enable this growth.

We believe that corporate India’s earnings will grow at a reasonable mid-teen in the future, backed by ongoing capital expenditure programs and an investment-driven push by the government and now eventually the private sector. We remain bullish on India.

Getting back to our Bhagavad Gita discussion – It’s interesting how Krishna advocates a balanced and moderate lifestyle towards achieving our spiritual goals. He says that one who sees himself in others, and thus experiences their joys and sorrows, becomes a Yogi or meditator of the highest calibre.

This is a simple, straightforward and practical teaching that is a central tenet of most spiritual practices: “Do unto others as you would have them do unto you.” Shri Krishna echoes that golden rule in this shloka. He says that the perfected meditator sees no difference between himself and other beings, just like we do not see differences between our left and right hand, or other parts of the body.

Himani Shah, CFA

SVP – Investments & Research

Alchemy Capital Management Pvt. Ltd.

Disclaimer: Investments are subject to market risks, please read all product /strategy related documents carefully before investing.

ear47mtete|0000025CE9F8|ThoughtLeadership|Description|5ED64856-1866-4D88-A6BC-2184E332C1F6