Sharp Bounce in Markets

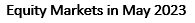

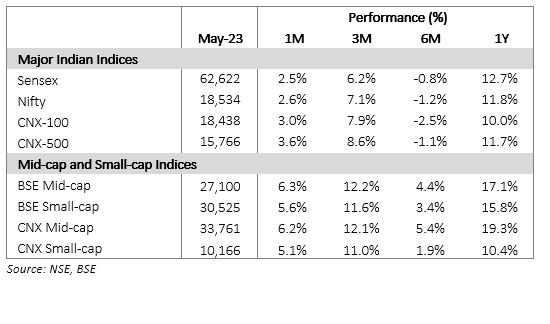

Equities performed strongly in May-23. The Nifty rallied 2.6% with an even stronger performance from small and mid-cap indices (see table below). Auto, IT and FMCG led the way with > 5% rallies while banks underperformed. The strong rally could lead to a near-term correction, but we remain constructive from a one-year perspective, given the strong earnings outlook and reasonable valuations.

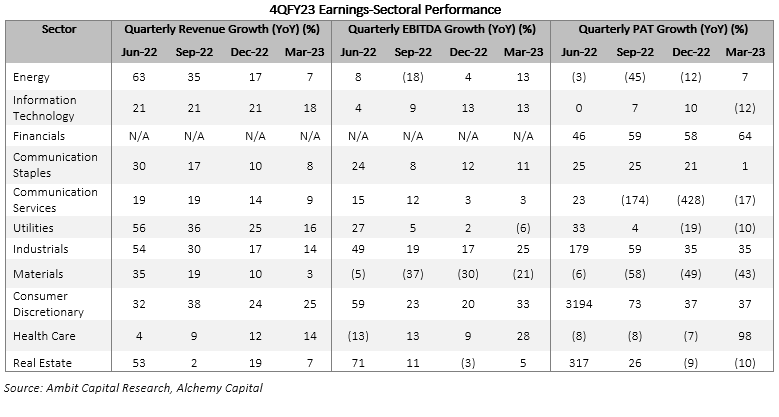

Earnings Season – Green Shoots

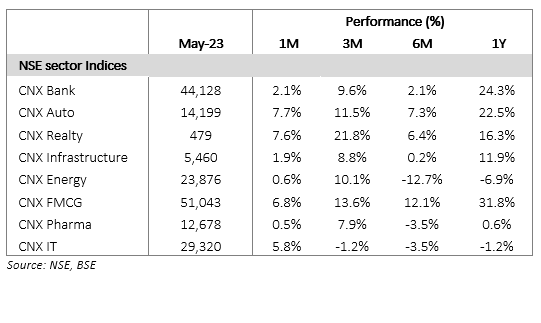

We believe that 4QFY23 was a strong quarter with 11% PAT growth, both y/y and q/q. Some key features stood out.

- Topline growth remained robust at 12% y/y (11% for non-financials). Some of this was undoubtedly due to high inflation but core growth continues to remain solid. This is despite some headwinds of slowing global growth and tiredness in domestic consumption. The sequential growth was also robust at 5%.

- There are some green shoots on the margins. EBITDA margins for non-financials (Nifty stocks) inched up by 22bps to 18.7%, well below the FY22 peaks but the bleeding seems to have stopped.

- The story is a bit different for the NSE 500. Growth was similar but the margin improvement was significantly more pronounced, leading to an EBITDA growth of 14% y/y. Overall, the broader universe delivered a 27% PAT growth vs the 11% for the Nifty. This was a significant reason for the outperformance of the small- and mid-cap indices, in our opinion.

- Industrials, Consumer discretionary (led by autos) and Healthcare were the best-performing sectors. Healthy topline growth and strong and rising margins drove exceptional PAT growth for all three sectors.

Macro Check – Steady Growth, High Stability

- 6.1% GDP growth in 4QFY23 was ahead of consensus expectations and stronger than 3QFY23 of 4.5%. This acceleration was driven by manufacturing and construction, reinforcing the thesis that we are probably in a strong capex cycle. The FY23 growth of 7.2% was also a strong print, ahead of street expectations.

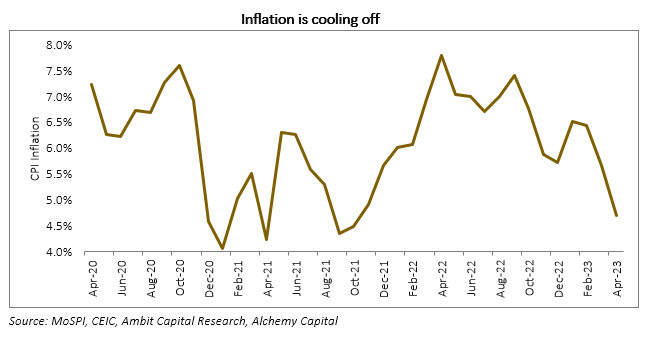

- Inflation is cooling off, led by weak commodity prices globally. The consumer price inflation came in at 4.7% in Apr-23, a significant step-down from Mar-23 of 5.6% and well within the RBI tolerance zone. We believe that the worst of inflation is over, and we should continue to see softer prints as we progress through FY24.

- The government maintained the FY23 fiscal deficit at 6.4% of GDP, in line with the revised estimates presented in the Union Budget earlier this year. We expect the government to stick to its fiscal consolidation plan in FY24 (to 5.9%) and that could have a contractionary impact on the economy.

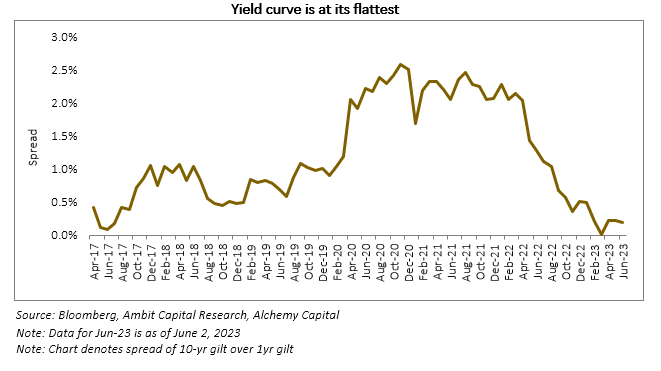

- Financial conditions remain very stable. The 10-year bond yield is stable at ~7%, driving a persistently flat yield curve for some time now. The rupee has also been resilient at the Rs 80-82 range for some time now, despite rising US rates and some current account pressures in 2022.

Going forward, we expect some compression in GDP growth but should stay at the 6-6.25% zone for FY24. This would be the first time in years that India clocks 6%+ GDP growth for three successive years. Interest rates are at their peak and the worst of currency pressures are also over. This creates a positive confluence for equity markets, especially as valuations are reasonable.

Seshadri Sen

Head of Research

Alchemy Capital Management Pvt. Ltd.

7x5pjg85n7|00004A29|AlchemyStatic|ThoughtLeadership|Description

7x5pjg85n8|00004A29B796|AlchemyStatic|ThoughtLeadership|Description|D099A10C-853D-46AB-AC73-A323927481E4

ear47mtete|0000025CE9F8|ThoughtLeadership|Description|B76D2BFA-D8CD-4651-87AA-0FFF2A62824E