EQUITY MARKET OUTLOOK - 07 Sep 2022

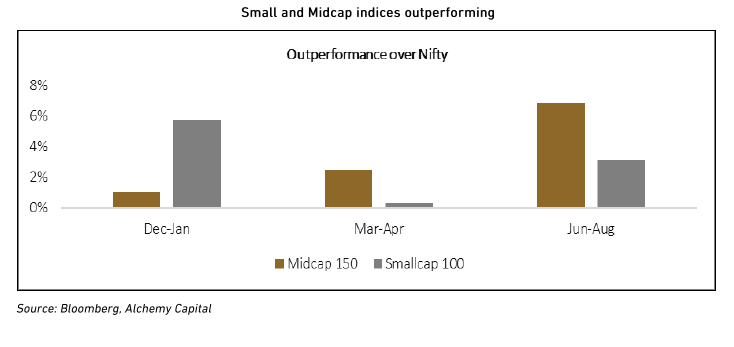

Indian markets remained strong through Aug-2022 and we continue to be bullish on markets. The breadth of the current rally, with mid and small caps outperforming, reinforces our confidence. We believe that investors should look through near-term volatility and ensure that their long-term allocation to equities remains stable. Timing the markets remains risky and holding back in anticipation of a correction may turn out to be a suboptimal strategy.

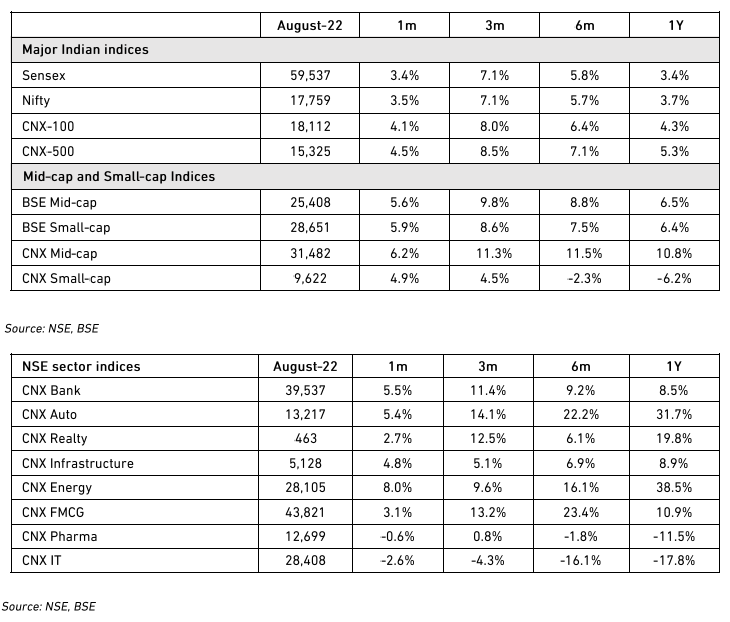

Equity Markets in August 2022

Powering Through Tightening

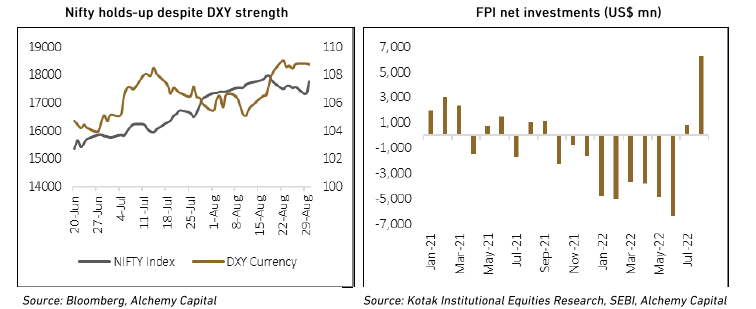

Global and local financial conditions have been tightening through the last few weeks; with greater intensity since the cautious speech by Fed Chairman Jerome Powell at Jackson Hole on 26-Aug 2022. The Fed and the RBI have continuously tightened through CY22 and the DXY has rallied strongly. Nevertheless, the Indian markets have rallied by 17% since 20-Jun 2022, with better breadth than any of the other mini-rallies in CY22.

This counter-intuitive move is an illustration of the challenges in predicting short-term movements in the broader market. The biggest positive, of course, has been the abatement of FPI selling in the markets, which was probably front-loaded in 1HCY22 in anticipation of continued Fed tightening – incremental rate hikes are thus not affecting flows to the same extent.

Positive Fundamental Triggers

The headwinds of global tightening are being offset by multiple positives on the domestic macro:

-

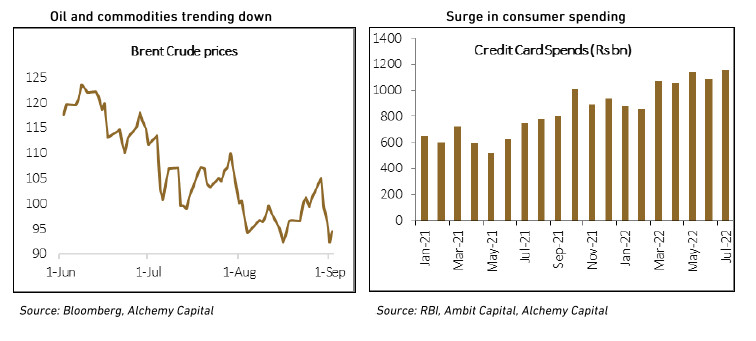

Consumer demand remains strong, despite high inflation. Mass market products are still struggling, but the premium markets seem to be growing across categories, with autos making a strong comeback in FY23. One of the strongest evidence is from the surge in credit card spends, some of which is coming from high-contact services segments like travel and tourism.

-

Global commodity prices are steady-to-weak, led by global oil prices. This should help moderate headline inflation in 2HFY23, and also give companies breathing room to improve margins, hold prices or invest for growth.

-

The capex revival continues. The outlook for government spending remains bright, especially with the buoyancy in tax revenues that is coming through. Private capex is also kicking in, led by a combination of strong underlying demand, continued export opportunities and favorable policy conditions.

-

The rupee has been holding firm, despite the DXY strength. As we discussed in our last month blog, the rupee has a strong long-term correlation with equities and its relative strength is expressing itself in the resilience of the broader equity markets.

Breadth of the Rally

The breadth of the latest of three mini-rallies in CY22, has been notable. The midcap and small cap indices have significantly outperformed the Nifty in the mini rally since 20 June 2022, and the gap seems to be trending upwards. The stronger participation from off-index stocks is, in our view, part of a longer-term trend. As we enter a sustained period of steady growth for the Indian macro, the markets are unlikely to be concentrated like in the decade ending 2020.

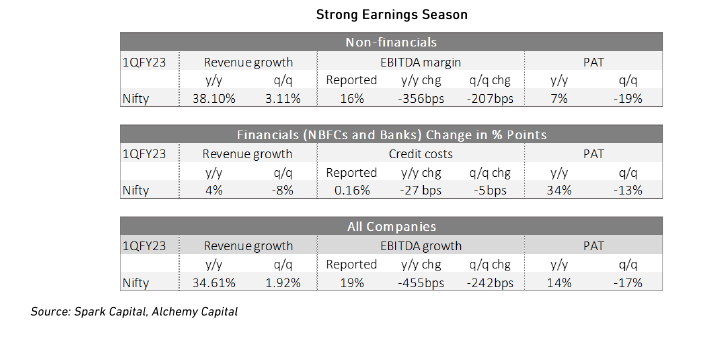

Earnings Review

The 1QFY23 earnings season was largely positive, and reinforced the positive momentum in the markets.

-

Top-line growth remained strong, though coloured by a weak base. The two-year CAGR is still somewhat muted, indicating that the economy has probably still not returned to full potential after COVID. We think that the momentum will continue to improve through FY23 on the back of strong consumer demand and continued revival of capex.

-

Margins pressures continued this quarter. This should start bottoming out from here. The worst of the commodity price impact seems to have been absorbed over two quarters in 1HCY22, and companies dealt with it by a combination of cost-cutting and price hikes. That cycle seems to be approaching the end.

-

The results from financials were exceptionally strong. Top-line returned with loan growth and fees rebounding, whereas credit costs were unusually low, given the risk aversion since the pandemic and aggressive provisions through FY21/FY22. PAT growth was hurt by one-off bond losses, and should start normalising from 2QFY23.

Source: Alchemy Group Research, Bloomberg

Disclaimers

Information and opinions contained in the document are disseminated for the information of authorized recipients only and are not to be relied upon as advisory or authoritative or take in substitution for the exercise of due diligence and judgment by any recipient. This document and its contents has not been approved or sanctioned by any government authority or regulator.

This document does not constitute an offer to sell or a solicitation of an offer to buy any securities. Any such offer or solicitation will be made only by means of the appropriate confidential Offer Documents that will be furnished to prospective investors. Before making an investment decision, investors are advised to review the confidential Offer Documents carefully and consult with their tax, financial and legal advisors. This document contains depiction of the activities of Alchemy and the investment management services that it provides. This depiction does not purport to be complete and is qualified in its entirety by the more detailed discussion contained in the confidential Offer Documents. Any reproduction or distribution of this document, as a whole or in part, or the disclosure of the contents hereof, without the prior written consent of Alchemy, is prohibited.

Performance estimates contained herein are without benefit of audit and subject to revision. Past performance does not guarantee future results. Future returns will likely vary, and investment results will fluctuate. In considering any performance data contained herein, prospective investors should bear in mind that past performance is not indicative of future results, and there can be no assurance that the Fund will achieve comparable results or that the Fund will be able to implement their investment strategy or achieve their investment objectives will achieve comparable results.

The information and opinions contained in this document may contain “forward- looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “seek”, “should”, “expect”, “anticipate”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof. or other variations thereon or comparable terminology. Due to various risks and uncertainties, including those set forth under the Private Placement Memorandum/ Investment Agreement actual events or results or the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements.

These materials discuss general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. Certain information contained in these materials has been obtained from published and non-published sources prepared by third parties, which, in certain cases, have not been updated through the date hereof. While such information is believed to be reliable, Alchemy does not assume any responsibility for the accuracy or completeness of such information. Except as otherwise indicated herein, the information, opinions and estimates provided in this presentation are based on matters and information as they exist as of the date these materials have been prepared and not as of any future date, and will not be updated or otherwise revised to reflect information that is subsequently discovered or available, or for changes in circumstances occurring after the date hereof. Alchemy’s opinions and estimates constitute Alchemy’s judgment and should be regarded as indicative, preliminary and for illustrative purposes only

Performance results shown for the Fund are presented on a net basis, reflecting the deduction of, among other things: management fees, brokerage commissions, administrative expenses, and accrued performance allocation or incentive fees, if any. Net performance includes the reinvestment of all dividends, interest, and capital gains.

The net monthly return is derived by reducing the Fund’s gross performance by the application of the management fee, charged monthly in arrears, a subscription fee and a performance fee. The performance fee is charged annually and subject to a high water mark. Performance results are estimates until completion of the annual audit. Because some investors may have different fee arrangements and depending on the timing of a specific investment, net performance for an individual investor may vary from the net performance as stated herein.

Index performance and yield data are shown for illustrative purposes only and have limitations when used for comparison or for other purposes due to, among other matters, volatility, creditor other factors (such as number and types of securities) An index does not account for the fees and expenses generally associated with investable products. The S&P BSE 500 index is designed to be a broad representation of the Indian market covering all major industries in the Indian economy. The index consists of 500 constituents listed at BSE ltd. It is calculated using a float adjusted , market cap weighted methodology. The Rebalancing of the index occurs semi-annually in June and December.

7x5pjg85n7|00004A29|AlchemyIM|ThoughtLeadership|Description

7x5pjg85n8|00004A29B796|AlchemyIM|ThoughtLeadership|Description|02C25EE1-F054-4D77-88AC-46C4C3094AF9

ear47mtete|0000025CE9F8|ThoughtLeadership|Description|45A88575-9400-44DC-BA87-E185E78D3250