EQUITY MARKET OUTLOOK - 08 Oct 2021

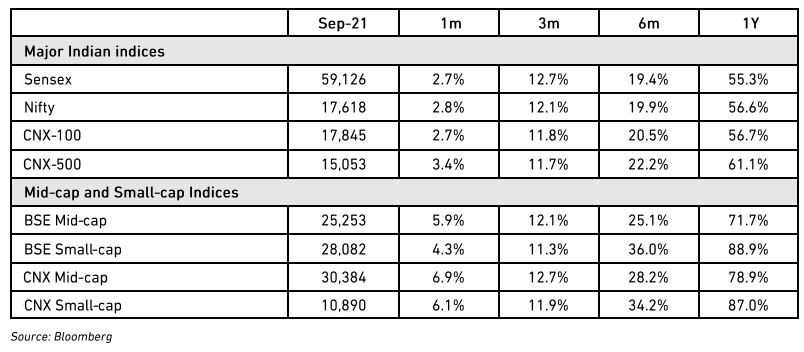

The markets were strong through September 2021 with a 2.8% rally in the Nifty led by Nifty Realty, Auto and Infra. Small- and mid-caps had a strong month with 2x returns over the broader markets (see table below). The focus now shifts to domestic financial stability and the opening-up of the economy against the backdrop of the upcoming earnings season. We remain positive on the broader markets and see cyclicals and opening-up trades as the key drivers. In the short term, however, there could be some volatility, but any correction would be a time to buy.

RBI “tightening” – too early to worry

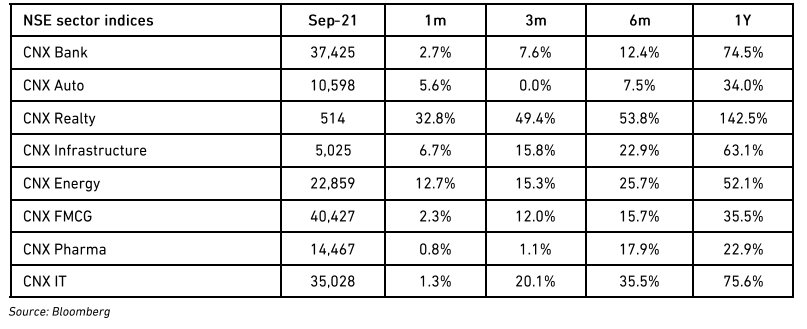

Given the sticky inflation, there have been increasing calls for the RBI to absorb excess liquidity while holding rates steady. This would push up short term interest rates and partially flatten the yield curve. We see little risk to growth or overall financial stability from such a move. Effective lending rates to borrowers are not likely to be affected, except for short-term instruments like commercial paper that form a small part of the overall pie. The move may actually improve margins for banks sitting on excess liquidity.

However, there could be a knee-jerk negative reaction in the markets to such an RBI Announcement, with financials and property most vulnerable. We think this would be short-term and the markets would quickly bounce back, once it becomes clear that the growth momentum is unlikely to be derailed. We believe that domestic financial conditions will remain benign and see little risk to growth or the currency. We would use any correction to add to our exposures in these sectors.

The normalising economy

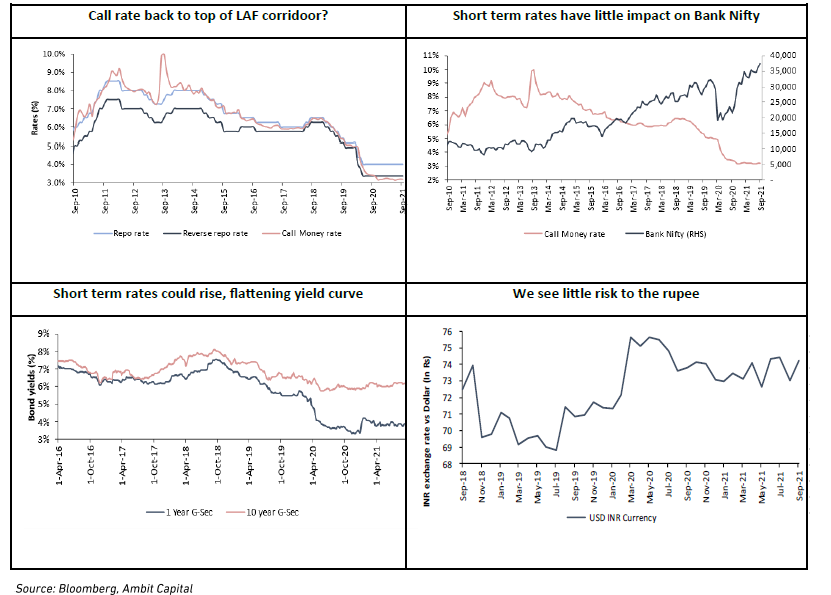

High-frequency indicators reinforce the anecdotal evidence that the economy is improving as the opening-up gathers pace. The steps by various states to gradually ease the lockdowns (school reopening is a big step) is driving this momentum. While we are still below pre-covid levels in many segments, we feel it’s a matter of time before normal service is resumed on the growth front.

One worry we have been flagging is the impact of the second wave on consumer sentiment and consequently, demand. The good news is that anecdotal evidence suggests that the reverse could happen and there is a possibility of a surge in “revenge buying”. The coming festival season will give us a clearer picture of the demand recovery, but companies seem to be optimistic of a strong festival season. Some of this optimism is in the price after the recent sharp rally in sectors like hotels, airlines, and consumer durables. This may be a short-term overhang but the high-quality companies in these segments remain attractive. We expect market leaders to gain share, having survived the post-Covid downturn at the expense of the laggards.

Earnings season – look out for margins

The Q2FY22 earnings season starts next week. Our key thoughts:

-

Topline growth will be strong on a base effect from a weak Q2FY21. In line with the broader economy, however, sales are still lagging pre-covid peaks in many sectors. We are not worried about this, as the rate of change and momentum is a better indicator of future trends than absolute levels.

-

We expect margins pressures to continue. Key input commodity prices have remained strong, and companies have been unable to pass this on to consumers for fear of disrupting the demand recovery. Other avenues of cost reduction were largely exhausted in FY21, and the only offset is from operating leverage, which is likely to play out in 2HFY22. Industrial companies are better off as it is easier to pass on costs in a B2B format. Consumer companies should face another quarter of soft margins.

-

Management commentary will be important. The companies will have strong visibility on festival season demand when earnings announcement comes through.

-

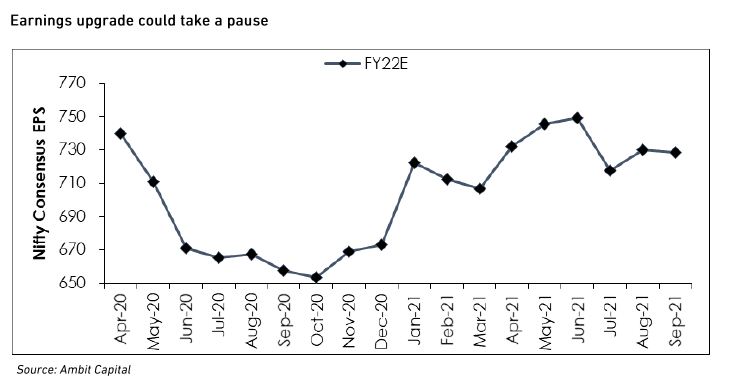

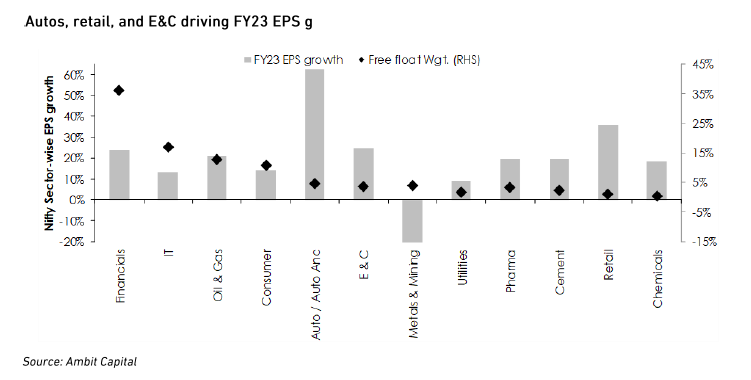

The earnings upgrade cycle for FY23 could take a pause for a few months. Most of the post-pandemic recovery has been priced in and the earnings season is unlikely to give greater insight to the street on FY23 earnings. We expect the next round of earnings revisions to commence in early CY22, driven by the extent of the demand recovery, the consequent operating leverage, and the direction of commodity prices.

Positive on markets

Our overall portfolio stance remains unchanged. We are minimising our cash positions and deploying fresh inflows as quickly as possible. Our focus remains on three broad sector groupings:

-

Cyclicals, as we believe that the capex cycle, both government and private, will play an important role in the broader macro recovery. Cyclicals are coming out of a multi-year underperformance cycle and the surviving companies are now much leaner on costs and balance sheet structures. This trade is here to stay for some time.

-

Opening up, as the economy recovers, companies that have suffered during the lockdown – travel and tourism, high-contact services, consumer durables – should benefit disproportionately. They will also benefit from survivorship – the stronger players who have emerged relatively unscathed from the lockdown are likely to gain market share.

-

Exporters, as the global recovery is likely to be an extended one with government and central banks erring on the side of caution before they start tightening. That, coupled with China cooling its export engines, will benefit Indian companies and we see that flow through to multiple sectors like IT, pharma, chemicals, and auto ancillaries.

We believe that investors should not try and time this market and correct any under-exposure to equities. There may be corrections but those are difficult to anticipate – in the meantime, opportunity losses could erode long-term returns.

The biggest risk is a third wave of the pandemic. That would extend the pain for high-touch companies and put balance sheets under stress. It may also change priorities for all economic agents – government, consumers, and companies. The continued roll-out of the vaccine and the relatively low level of fresh cases have kept those fears at bay, but it remains a key risk that we are watching out for.

7x5pjg85n7|00004A29|AlchemyIM|ThoughtLeadership|Description

7x5pjg85n8|00004A29B796|AlchemyIM|ThoughtLeadership|Description|7755FB04-B525-433D-9F3D-3532363B2FA2

ear47mtete|0000025CE9F8|ThoughtLeadership|Description|5E8738EC-6D73-49ED-963B-A513EA35FEF9