FY23 – Tailwinds Overcoming Risks: Stay Invested - 10 Nov 2022

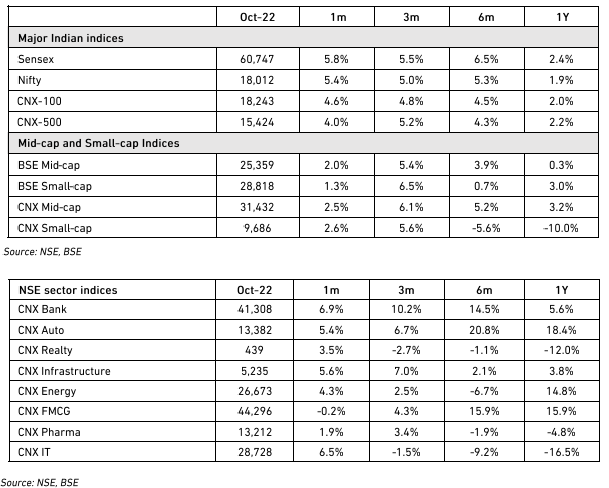

The markets saw a strong Oct-22 with large cap indices leading the charge. Banks and IT led the charge with significant outperformance. Hawkish commentary from the Fed has popped up as a speed-breaker in early Nov-22 and could put some dampener on near-term performance. The earning season saw strong topline growth but margin pressures for non-financials dented PAT growth.

We remain constructive on the markets. The rate cycle, both in the US and India, is nearing its peak and will cease to be part of the conversation from CY24, in our view. On the other hand, we see positive momentum from domestic demand and a sustained multi-year revival in the industrials sector.

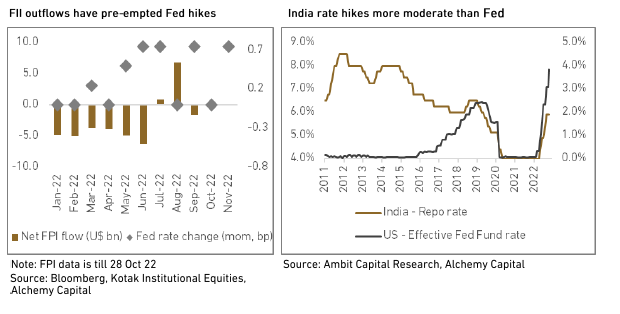

Fed rate hikes

The markets were disappointed with the Fed Chairman’s statements after the latest FOMC meeting. This is, incrementally, a negative but the bigger picture is that we are closer to the end of the rate hike cycle than the beginning. We believe the impact on India will be muted and transient for three reasons:

-

Much of the FII selling on the back of Fed tightening (rate hikes + balance sheet reduction) pre-empted the hikes. Going forward, there may be some additional selling but it is unlikely to be in the same magnitude as in 1HCY22. The now-extended period of Fed hikes may be a dampener for incremental buying, but we think the market can cope with that.

-

The contagion to India will be less impactful. We believe that the RBI will pause its rate hike cycle in late CY22 or early CY23, with a peak rate of around 5.5%. This is the mid-range of India’s historical rate cycles and is unlikely to significantly dampen demand or hurt borrower balance sheets.

-

There could be some pressure on the rupee in the short term, but that, too, would be transient. We do not envisage a scenario where the rupee comes under so much pressure that it destabilises financial conditions in India’s domestic market. Muted incremental FII selling and relatively narrow interest rate differentials underpin our confidence.

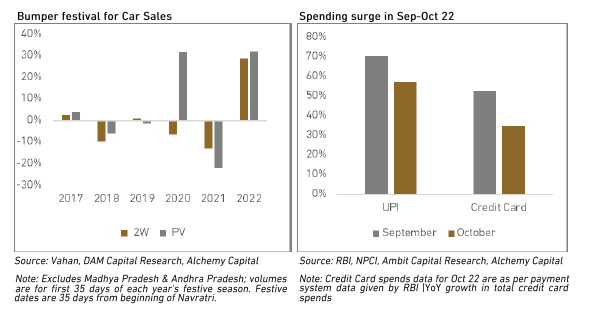

Strong festive season

Consumption demand through the festive season remained strong, despite high inflation and relatively higher interest rates. There were a few interesting facets to this

-

Auto sales have rebounded strongly, with supply chain challenges waning and underlying demand coming through. This is despite multiple challenges: rising fuel and ownership costs, higher prices/reduced discounting, and higher interest rates. Interestingly, demand is stronger in the slightly premium categories.

-

The festival sales promotion campaigns by e-commerce companies have been hugely successful in the last week of Sep-22. According to anecdotal data, mobiles and white goods saw a massive surge in sales during this period. There were worries that demand in these categories had been front-ended during the Covid period, but there does not seem to be any signs of abatement.

-

Credit card transactions showed a massive rebound in this period, indicating a surge in high ticket spending. Despite such high growth, cards continued to lose market share to UPI – indicating that underlying demand has been very powerful through this period.

Key Sectors

We see three key sectors that would impact the indices in the coming 2-3 quarters. We remain constructive on all three, but believe that opportunities for most of these sectors would lie in non-index stocks, going down the market cap curve.

-

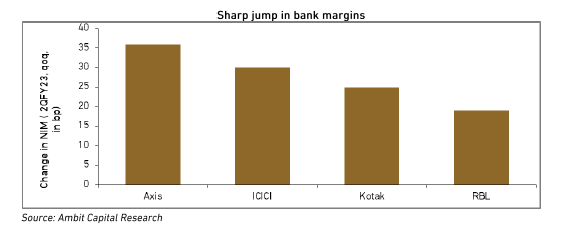

Financials.Bank results were exceptionally strong. The sharp hikes in repo rates led to a front-ended jump in loan yields, driving margins up. Some of these gains will be lost in FY24 as deposit pricing catches up, but changes in loan mix towards unsecured lending will partly help cushion this. Banks are also enjoying a golden period in asset quality, and we see further cuts in provisioning forecasts by the street. Our approach to the sector is selective – we see outperformance opportunities in relatively cheaper stocks that have rerating potential, rather than expensive stocks that are dependent purely on earnings compounding for future returns.

-

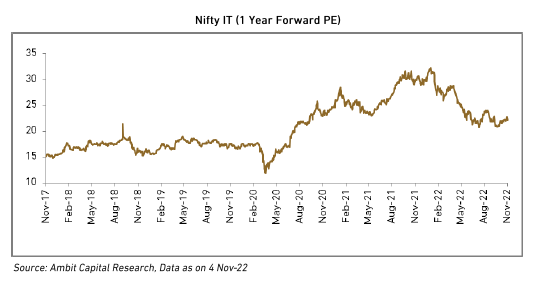

Information Technology.The sector is undoubtedly facing headwinds – coming off a high post-Covid base and now will have to deal with an imminent slowdown/recession in Europe and the USA. On the other hand, the sector PE has also derated significantly during the year as it faced the brunt of selling in 1HCY22, partly driven by the derating of tech stocks in the USA. We think the correction has made the sector reasonably valued and attractive from a medium-term perspective, even if the short-term outlook may be uncertain.

-

Industrials.We see a long multi-year growth runway for industrials (capital goods, infra, auto ancillaries). Demand is returning as the capex cycle starts to slowly revive, aided by both government and private spending. Global supply-chain realignments add to the demand tailwinds, with policy support from the Indian government. The companies who have survived the “lost decade” of 2011-2020 are now able to exploit this new growth cycle. There are some pockets of stretched valuations, but the strong multi-year growth outlook gives us confidence in this sector, and we continue to look for fresh ideas in this space.

Results summary

We are more than halfway through the earning season. Here are some of the key takeaways:

-

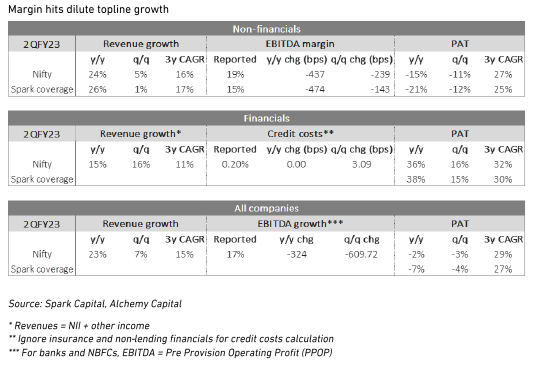

For non-financials, PAT growth has been weak – a small contraction in aggregate. This was, however, largely expected as there are some temporary factors that have driven this outcome.

-

Topline growth was robust for non-financials. Revenue growth was 24% y/y – even the three-year CAGR (which smoothens out the Covid-era base effects) is strong at 16%. This is a sign that demand growth across segments – both consumer and industrial – is on an upswing. Our constructive thesis on the markets is largely based on this trend.

-

Margins contracted significantly due to RM pressures from rising commodity prices. We are closer to the end of that cycle and expect margins to recover from CY22 as price hikes get passed on to the end-users. Also, commodity prices are stabilising so incremental pressure on RM prices should abate.

-

As discussed above, bank results were strong and offset the weak numbers from non-financials. We expect this trend to continue, though FY24 could see some pressure on margins.

-

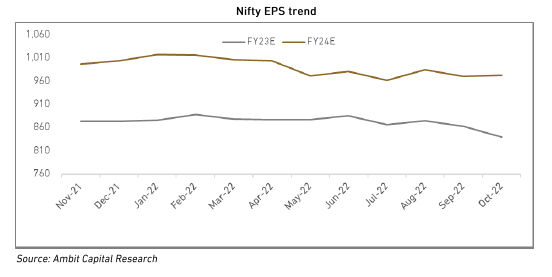

The impact on earnings forecasts has been minimal. FY24 consensus Nifty EPS was stable through Oct- 22 (refer chart below) and is down a mere 4% from Jan-22. As margins rebound, we see an upside to consensus forecasts from current levels.

Source: Alchemy Group Research, Bloomberg

Disclaimers

Information and opinions contained in the document are disseminated for the information of authorized recipients only and are not to be relied upon as advisory or authoritative or take in substitution for the exercise of due diligence and judgment by any recipient. This document and its contents has not been approved or sanctioned by any government authority or regulator.

This document does not constitute an offer to sell or a solicitation of an offer to buy any securities. Any such offer or solicitation will be made only by means of the appropriate confidential Offer Documents that will be furnished to prospective investors. Before making an investment decision, investors are advised to review the confidential Offer Documents carefully and consult with their tax, financial and legal advisors. This document contains depiction of the activities of Alchemy and the investment management services that it provides. This depiction does not purport to be complete and is qualified in its entirety by the more detailed discussion contained in the confidential Offer Documents. Any reproduction or distribution of this document, as a whole or in part, or the disclosure of the contents hereof, without the prior written consent of Alchemy, is prohibited.

Performance estimates contained herein are without benefit of audit and subject to revision. Past performance does not guarantee future results. Future returns will likely vary, and investment results will fluctuate. In considering any performance data contained herein, prospective investors should bear in mind that past performance is not indicative of future results, and there can be no assurance that the Fund will achieve comparable results or that the Fund will be able to implement their investment strategy or achieve their investment objectives will achieve comparable results.

The information and opinions contained in this document may contain “forward- looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “seek”, “should”, “expect”, “anticipate”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof. or other variations thereon or comparable terminology. Due to various risks and uncertainties, including those set forth under the Private Placement Memorandum/ Investment Agreement actual events or results or the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements.

These materials discuss general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. Certain information contained in these materials has been obtained from published and non-published sources prepared by third parties, which, in certain cases, have not been updated through the date hereof. While such information is believed to be reliable, Alchemy does not assume any responsibility for the accuracy or completeness of such information. Except as otherwise indicated herein, the information, opinions and estimates provided in this presentation are based on matters and information as they exist as of the date these materials have been prepared and not as of any future date, and will not be updated or otherwise revised to reflect information that is subsequently discovered or available, or for changes in circumstances occurring after the date hereof. Alchemy’s opinions and estimates constitute Alchemy’s judgment and should be regarded as indicative, preliminary and for illustrative purposes only

Performance results shown for the Fund are presented on a net basis, reflecting the deduction of, among other things: management fees, brokerage commissions, administrative expenses, and accrued performance allocation or incentive fees, if any. Net performance includes the reinvestment of all dividends, interest, and capital gains.

The net monthly return is derived by reducing the Fund’s gross performance by the application of the management fee, charged monthly in arrears, a subscription fee and a performance fee. The performance fee is charged annually and subject to a high water mark. Performance results are estimates until completion of the annual audit. Because some investors may have different fee arrangements and depending on the timing of a specific investment, net performance for an individual investor may vary from the net performance as stated herein.

Index performance and yield data are shown for illustrative purposes only and have limitations when used for comparison or for other purposes due to, among other matters, volatility, creditor other factors (such as number and types of securities) An index does not account for the fees and expenses generally associated with investable products. The S&P BSE 500 index is designed to be a broad representation of the Indian market covering all major industries in the Indian economy. The index consists of 500 constituents listed at BSE ltd. It is calculated using a float adjusted , market cap weighted methodology. The Rebalancing of the index occurs semi-annually in June and December.

7x5pjg85n7|00004A29|AlchemyIM|ThoughtLeadership|Description

7x5pjg85n8|00004A29B796|AlchemyIM|ThoughtLeadership|Description|71A61EDF-7FE4-4D70-AE25-6AD3FFA1A111

ear47mtete|0000025CE9F8|ThoughtLeadership|Description|DF86B460-C12F-465B-BCEC-AC8B9ABDC972