EQUITY MARKET OUTLOOK - 11 Nov 2021

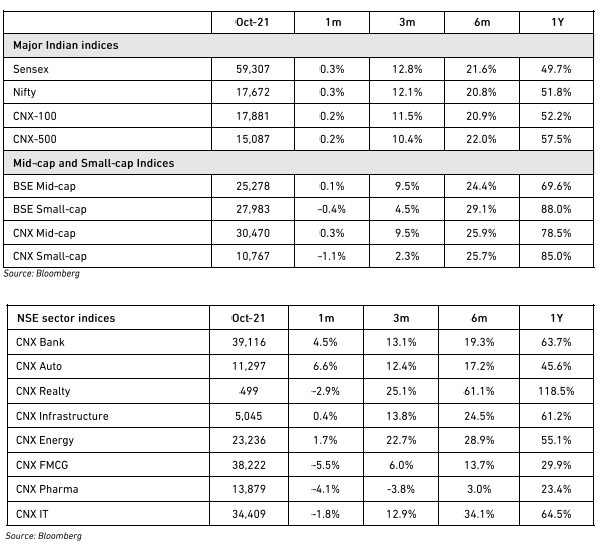

A volatile October 2021 ended on a weak note, but the market was flat over the month. SMID* sectors underperformed, along with high-beta sectors like commodities. We remain optimistic on the markets given the strong growth rebound, resilient earnings and broadening base of publicly listed companies.

Economy rebound

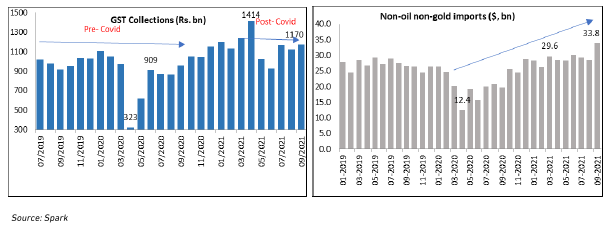

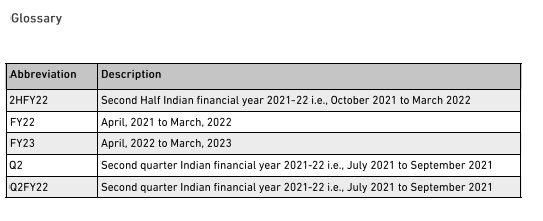

We remain positive on the economy and expect a sharp rebound in growth from 2HFY22 onwards. A confluence of positives is driving this recovery and we see a number of signs that this could last.

-

The short-term factor is, of course, the opening up of the economy. Except for small pockets, the incidence of Covid-19 is receding, and local administrations are slowly restoring normality to everyday life. Schools, cinemas, public gatherings are all starting to reopen, driving specific categories of consumption as well as improving consumer confidence. Banks, retail and travel/entertainment are three sectors that benefit from this.

-

Our fears that the intensity of the second wave could hurt consumer sentiment seems to have been unfounded. Anecdotal evidence and commentary from managements seem to indicate a strong demand recovery over the festive season. We believe this has been driven by a combination of strong income growth for formal sector workers and higher savings from the 5-6 quarter period of lockdowns. The demand recovery has been tilted towards higher-income groups – we think this should become more broad-based by FY23 as the recovery becomes more balanced.

-

Inflation remains a pebble in the shoe. Companies are getting more aggressive in passing on input costs and this should accelerate after the festive season passes. Demand for premium products will be relatively unaffected, but this is a stress point for bottom-of-pyramid consumers. We see down-trading for a few more quarters. The key to a turnaround is for income recovery to filter down the income strata – a recovery in capex and real estate would be a key enabler for that.

Earnings

The earnings season for Q2FY22 is still under way and we will have a full analysis by next month. Our preliminary thoughts are these:

-

Growth recovery - Q2 is a seasonally weak quarter for many sectors but the recovery has still surprised most analysts. True, there was a base effect in play, but the absolute numbers seemed to have been strong, reinforcing our positive outlook on the demand bounce-back. Supply-chain stresses, especially in auto, has left some of this demand unfulfilled, however.

-

Acute margin pressures - Many consumer companies took the higher commodity prices on the chin, this quarter. Some have taken remedial measures with price hikes, especially as the festive season draws to a close. We see continued gross margin pressures across the board as commodity prices remain elevated.

-

Bank asset quality - A notable feature has been the turnaround in asset quality for most banks. The post-covid surge in credit costs appears to be over and done with, and banks are looking ahead with more confidence. The larger, high-quality banks, seem to have over-provided and this could lead to a collapse in credit costs in FY23.

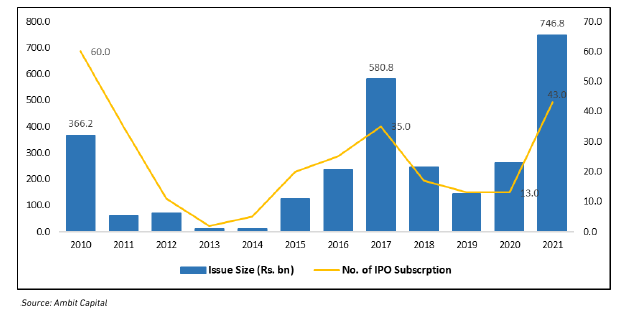

IPO rush and liquidity

The rush of IPOs continued unabated in CY21 with companies from diverse sectors coming to the market. This has, we believe, created some volatility in the market but it has some positives too. An IPO glut has a multi-faceted impact on markets.

-

Market diversification - The IPO glut has brought new categories of companies to the market, new-age internet being the most prominent. This gives public market investors the opportunity to participate in emerging trends of the broader economy, helping diversify portfolios and hedge risks.

-

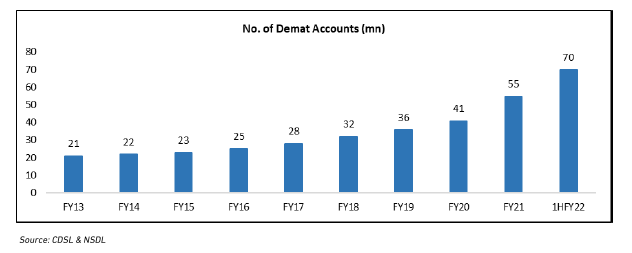

New investors - An IPO glut usually triggers the entry of new investors to the market. This has been the case in FY22 as well. Of course, some of these investors may drop off when the market corrects, but the net impact is still a positive. This is an important catalyst to broaden India’s underpenetrated capital markets.

-

Liquidity impact temporary - There have been some worries that the IPO glut could have triggered a secondary market sell-off and impact broader market returns. Even if it were the case, we think this would be temporary. The broader market direction is driven by both liquidity and earnings, and the issuance of more paper usually does not disrupt a medium-term trend.

-

Invest selectively - We are selective in investing in newly listed companies. The attraction is of the opportunity to participate in new frontiers of the economy, but the risk is that new companies have no track record, and it takes a while for the markets to get used to the management. We do not stay away, but do not chase IPOs either.

The biggest risk remains a third wave of Covid-19. The overall trend has been positive for the last few months (barring a few states) but we have to remain vigilant for a post-festival surge or new variants coming through. The pace of vaccination also remains robust, though the coverage of double-dosed population is still a work-in-progress.

Our strategy remains unchanged. We are minimising cash and are continuing to focus on quality companies with strength in improving return ratios and cash generation. We are emphasising three broad sectors – cyclicals, exporters and beneficiaries of the economy opening up.

Source– Alchemy Group Research

7x5pjg85n7|00004A29|AlchemyIM|ThoughtLeadership|Description

7x5pjg85n8|00004A29B796|AlchemyIM|ThoughtLeadership|Description|CD137E27-3A77-4959-9CD6-E21C6AC14EC5

ear47mtete|0000025CE9F8|ThoughtLeadership|Description|83FBF048-6497-40C9-96D0-B6377F19A05C