EQUITY MARKET OUTLOOK - 09 Dec 2020

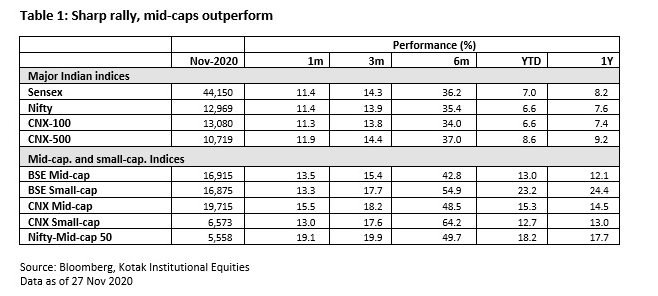

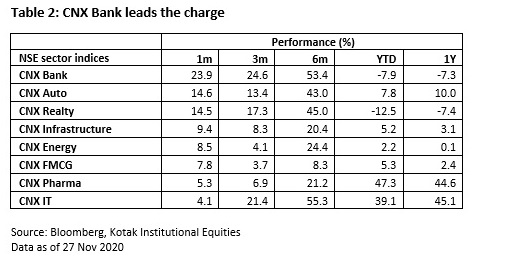

It was another strong month for the markets with the Nifty rising 11.4 % led by banks, metals and capital goods. The key drivers were a) a favourable outcome on the US elections which helped contain global macro risks, b) continued normalisation in the Indian economy, reinforced by news of an imminent vaccine for COVID-19, c) positive signals coming through on retail asset quality for banks and d) a healthy earning season driving upgrades across a broad spectrum of sectors. The main risk to the market is another dip in consumption in CY21, but the likelihood is low. We continue to focus on our three pillars – high deployment levels, focus on quality companies with market leadership and sector diversification within the portfolio.

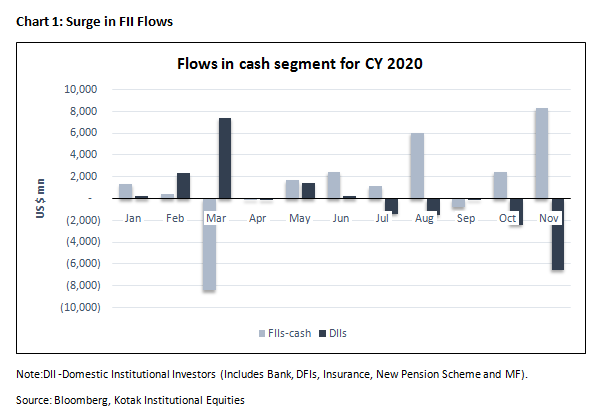

Global tailwinds : The positive outcome on the US elections has helped contain global risks. The accommodative stance of global central banks, mainly the Fed, is likely to continue until the growth damage from COVID is repaired. Moreover, there is a possibility that the Joe Biden administration could resort to a strong fiscal stimulus. The stage looks set for favourable conditions for across the world, including emerging market equities. India is likely to continue to benefit from that scenario, as was evident from the $9.37bn FPI inflows in November, up ~5x m/m.

Continued normalisation : The economy continues its normalisation path. Our internal research on economic activity index shows an improvement from 96% to 97.5% over October 2020 – some of the indicators have shown further improvement in November 2020. The onset of winter, however, has caused a spike in Covid cases in some states like Gujarat and Delhi. We do, however, believe that the upward momentum should sustain as we progress into CY21.

There has been some debate about the market rally being disconnected from the broader economy, but we think there are some specific factors driving this. First, we are in a two-speed economy, where some parts of the economy are recovering much faster than the rest. The companies with strong weightage in the economy are more geared to this fast-recovering segment. Second, markets are looking ahead, and prices are discounting the probability that stronger companies will normalise quicker than the rest. As long as the normalisation continues, the near-term pain will be ignored.

Earnings review : The 2Q FY21 earnings season was encouraging. Our portfolio, ex-financials, saw weighted average revenues flat (vs -17% in 1Q) and PAT growth at 9% vs -2% in 1Q, all yoy. The PAT growth for financials was even stronger at 112% y/y, with one-offs on taxes offsetting the higher NPL provisions – operating profit, though, grew at a healthy 13.1%. Also, 70% of our portfolio companies beat consensus estimates for this quarter. This is driving an upward earnings revision cycle – consensus FY22 EPS forecast for 30 of the 50 Nifty companies are higher in November than the pre-Covid February levels. The street is clearly expecting a rapid normalisation in FY22.

Key risk : The biggest worry is that the recent growth is being driven by pent-up demand and could falter as we get into CY21. Our comfort comes from a) positive management commentary across many discretionary consumption sectors and b) evidence that white-collar wages have been relatively unaffected. It is a risk that we are, however, keeping our eye out for, and we will know more as we get into CY21.

Source– Alchemy Group Research

7x5pjg85n7|00004A29|AlchemyIM|ThoughtLeadership|Description

7x5pjg85n8|00004A29B796|AlchemyIM|ThoughtLeadership|Description|B86170AD-1726-40C5-88AC-DCF1C52E40A4

ear47mtete|0000025CE9F8|ThoughtLeadership|Description|5DA9A849-B147-44EB-A037-DBC77B78D223