Equity Market Outlook - 10 Jun 2021

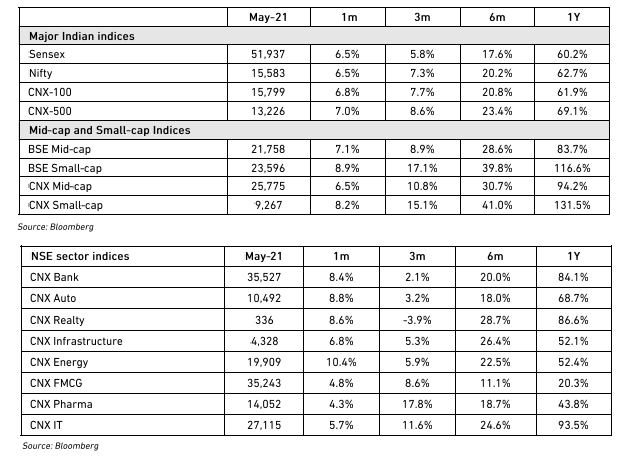

The markets bounced back in May after two flat months, led primarily by the second Covid wave starting to recede and some acceleration in vaccination. Some of the laggard sectors over Feb-Mar ’21 like banking, auto, energy and infrastructure led the market revival. The earnings season was mixed but the impact of the second wave does not seem to have been as severe as in 2020, which fuelled some optimism.

Economy recovering

The second Covid wave is steadily receding, leaving behind a distressing humanitarian crisis. In the short term, the “unlock” impact would be positive as businesses that are directly impacted by closures start to slowly recover. There are, however, lingering worries over the revival. The impact of Covid on personal wealth and income is still uncertain. Moreover, we expect state governments to be more circumspect in opening up after the experience of Mar-May 2021.We will have to wait to see if pent-up demand plays as quickly as it did in 2020. A full consumption recovery is likely once vaccination coverage has made headway by end CY21.

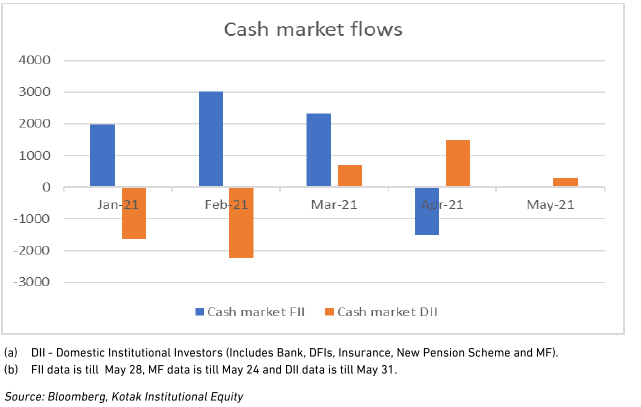

Overseas flows stabilise

A remarkable feature of the May‘21 rally was the weak institutional flows over the month. FII cash volumes stabilised after the sharp April’21 outflows, though there was some selling in derivatives. There was no offset from Domestic Institutional Investors (DII) buying to support the markets either. We think this is a combination of increased retail participation, enhanced confidence as the second wave receded and the broad-based earnings outlook (discussed in the next section). FII flows may not match the highs of 2HCY20 in the near term, but we see an overall positive outlook as the global economy revives against a background of abundant liquidity and an overall rebalancing towards emerging markets.

Earnings season: positive signs

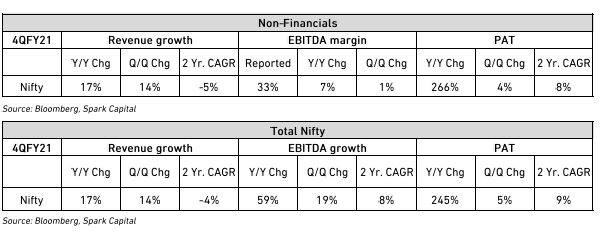

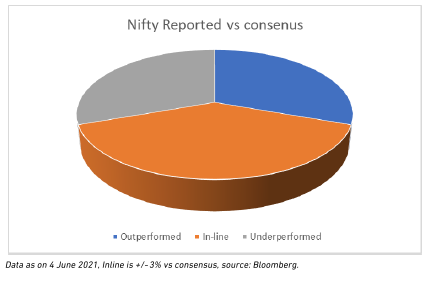

Nifty companies (ex-financials) showed a modest bounce-back in growth and profitability, despite a ~200bp drop in gross margins as the impact of commodity price inflation is starting to bite manufacturers. Financials, of course, showed a sharp growth in PAT due to the base effect of one-time COVID provisions that started in 4QFY21. Overall, there was an even distribution of surprises and disappointments in the 46 Nifty companies to have reported so far.

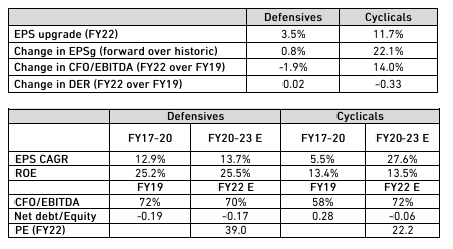

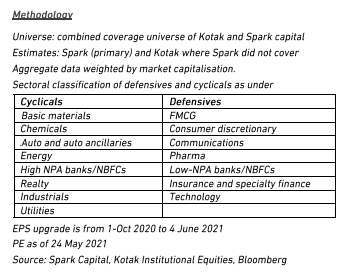

Preference for cyclicals

Some defensive sectors like consumer durables are showing some momentum, but we believe that cyclicals will continue to outperform. The macro tailwind is in their favour, as we think government and capital spending is more likely to drive the revival than consumption. The consumption names, no doubt, have a better history of steady growth and stronger balance sheets. The cyclical sectors are showing incremental improvement on three counts a) faster EPS growth over FY20-23, b) improved CFO/EBITDA conversion and c) improving balance sheets through deleveraging (see table below). This revival of earnings is likely to be the catalyst to a closing of the valuation gap after a multi-year outperformance from defensives.

Source– Alchemy Group Research

7x5pjg85n7|00004A29|AlchemyIM|ThoughtLeadership|Description

7x5pjg85n8|00004A29B796|AlchemyIM|ThoughtLeadership|Description|69C35883-3632-4256-B5B6-DE72D8A07CBA

ear47mtete|0000025CE9F8|ThoughtLeadership|Description|8700868F-40A9-4FB9-969E-865F159D2B8E