EQUITY MARKET OUTLOOK - 26 Apr 2023

Analysis of key numbers for FY24 gives us some comfort on the broader markets. Valuations have meaningfully corrected and should be supportive. The earnings outlook also remains positive with consensus estimates indicating a broad-based recovery in FY24. The worries are that the macro could disappoint, triggering further downgrades. We believe that FY24 should provide modest, below-trend returns but the downside risks are also compressed. Sector rotation will continue, in our view, and valuations will be as important a determinant of stock returns and core fundamentals.

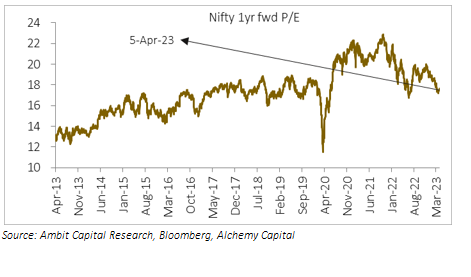

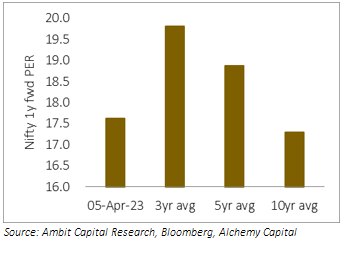

Valuations

Valuations have meaningfully corrected and are now at 17.6x 1yf (as of 5 Apr 23) vs the peak of 22.5x in Oct-21. This is somewhat coloured by elevated consensus forecasts for FY24 (15% EPSg) but we believe that margin recovery still makes this an achievable target. To put it in context, as of 5-Apr- 23, Nifty PER is below the 3-year, 5-year and 10-year average. The attractive valuations imply that the downside for the broader market is limited from this level; the upside would be driven by earnings resilience and the trend in global and domestic monetary conditions.

Earnings Troughing Out

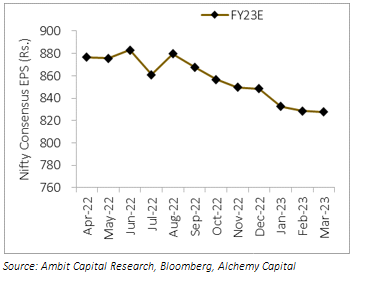

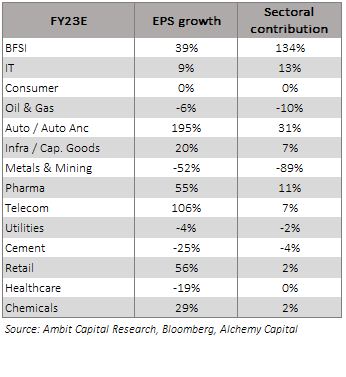

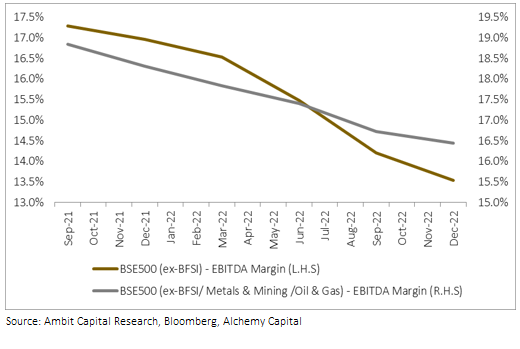

- FY23 earnings were disappointing. A 5.8% downgrade over a 12m period resulted in EPSg being pushed into single digits at 9.8%. Almost all the growth came from BFSI: ex-financials, the EPS was flat (+0.8% y/y). The major culprit was cost-led margins as commodity prices played havoc with manufacturer margins as the ferocity of the move, after the Ukraine war broke out, left producers little headroom to pass on the increased costs. This is still a consensus forecast and we shall know more about the outcome in the ensuing earnings season.

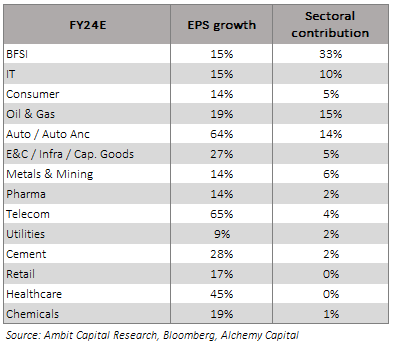

- The key to FY24 earnings recovery could be margins. We believe EBITDA margins should start to recover on the back of steady commodity prices, price hikes by producers and operating leverage – consensus is building that in. The risks, if any, are on topline growth. A high base and slowing demand are likely to drive slower revenue growth – some of that is built in to FY24 consensus estimates but there is some downside risk to that.

- The other positive is that earnings growth should be more broad-based. As discussed earlier, financials accounted for almost the entire EPSg for FY23. The growth is expected to be more well-distributed in FY24, with meaningful contributions from IT, Autos and Energy.

- The FY23 experience, however, keeps us on our toes. The double-digit EPSg expectations at the beginning of FY23 quickly faded into sustained downgrades are now at 9.8% y/y (as of 5-Apr-23). We do not expect such significant downgrades for FY24 but do see a couple of key risks. First, consumption is expected to slow on the back of a base effect and higher interest rates. Second, margin recovery is dependent on companies exercising pricing power and that may get spread out over a longer period than envisaged. Our base case, however, is that consensus earnings hold up, but we will monitor the risks.

Longer-Term Outlook

We believe that FY23/FY24 are speed-breakers in a positive medium-term India story. The key drivers of India’s medium term growth potential: positive demographics, economic reform, rapid digitisation, and the recovery in manufacturing remain intact and the cyclical slowdown does not negatively impact that. This, in our view, impacts the markets in two ways. First, it will keep valuations elevated as the premium for long-term potential remains sticky. Second, we believe it strengthens the case for holding quality companies as they are in a better position to weather the downturn and capitalise on the recovery when it happens.

Read our detailed blog on India’s long term potential from Aug-22.

Broader Market Theme: Quality + Valuations

We see three broad themes for FY24:

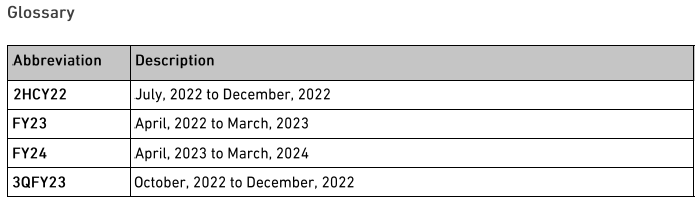

- Quality stocks would continue to be the focus. In a period of elevated global uncertainty, high commodity prices and tight monetary conditions, low-quality companies become more vulnerable and present asymmetric risk-reward risk (negatively). After a brief spell of underperformance in 2HCY22, we see quality ruling the markets in the coming year.

- Valuations, however, will be key to picking winners. Fundamentals and quality act as great filters, but stock performance is being increasingly driven by valuations. We are seeing an intensifying trend where richly valued stocks are struggling to outperform and relatively cheaper stocks are doing better.

- Sector rotation is likely to continue. As the broader market may not show clear trends, investors are likely to keep shifting between sectors, driven by relative valuations and short-term fundamental outlook. Investors with relatively longer-term horizons, we believe, will have to adapt. On the one hand, following short term trends is likely. On the other hand, ignoring relative valuations can lead to underperformance. The truth, as always, will be in the middle.

Source: Alchemy Group Research, Bloomberg

Longer-Term Outlook

Disclaimers

Information and opinions contained in the document are disseminated for the information of authorized recipients only and are not to be relied upon as advisory or authoritative or take in substitution for the exercise of due diligence and judgment by any recipient. This document and its contents has not been approved or sanctioned by any government authority or regulator.

This document does not constitute an offer to sell or a solicitation of an offer to buy any securities. Any such offer or solicitation will be made only by means of the appropriate confidential Offer Documents that will be furnished to prospective investors. Before making an investment decision, investors are advised to review the confidential Offer Documents carefully and consult with their tax, financial and legal advisors. This document contains depiction of the activities of Alchemy and the investment management services that it provides. This depiction does not purport to be complete and is qualified in its entirety by the more detailed discussion contained in the confidential Offer Documents. Any reproduction or distribution of this document, as a whole or in part, or the disclosure of the contents hereof, without the prior written consent of Alchemy, is prohibited.

Performance estimates contained herein are without benefit of audit and subject to revision. Past performance does not guarantee future results. Future returns will likely vary, and investment results will fluctuate. In considering any performance data contained herein, prospective investors should bear in mind that past performance is not indicative of future results, and there can be no assurance that the Fund will achieve comparable results or that the Fund will be able to implement their investment strategy or achieve their investment objectives will achieve comparable results.

The information and opinions contained in this document may contain “forward- looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “seek”, “should”, “expect”, “anticipate”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof. or other variations thereon or comparable terminology. Due to various risks and uncertainties, including those set forth under the Private Placement Memorandum/ Investment Agreement actual events or results or the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements.

These materials discuss general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. Certain information contained in these materials has been obtained from published and non-published sources prepared by third parties, which, in certain cases, have not been updated through the date hereof. While such information is believed to be reliable, Alchemy does not assume any responsibility for the accuracy or completeness of such information. Except as otherwise indicated herein, the information, opinions and estimates provided in this presentation are based on matters and information as they exist as of the date these materials have been prepared and not as of any future date, and will not be updated or otherwise revised to reflect information that is subsequently discovered or available, or for changes in circumstances occurring after the date hereof. Alchemy’s opinions and estimates constitute Alchemy’s judgment and should be regarded as indicative, preliminary and for illustrative purposes only

Performance results shown for the Fund are presented on a net basis, reflecting the deduction of, among other things: management fees, brokerage commissions, administrative expenses, and accrued performance allocation or incentive fees, if any. Net performance includes the reinvestment of all dividends, interest, and capital gains.

The net monthly return is derived by reducing the Fund’s gross performance by the application of the management fee, charged monthly in arrears, a subscription fee and a performance fee. The performance fee is charged annually and subject to a high water mark. Performance results are estimates until completion of the annual audit. Because some investors may have different fee arrangements and depending on the timing of a specific investment, net performance for an individual investor may vary from the net performance as stated herein.

Index performance and yield data are shown for illustrative purposes only and have limitations when used for comparison or for other purposes due to, among other matters, volatility, creditor other factors (such as number and types of securities) An index does not account for the fees and expenses generally associated with investable products. The S&P BSE 500 index is designed to be a broad representation of the Indian market covering all major industries in the Indian economy. The index consists of 500 constituents listed at BSE ltd. It is calculated using a float adjusted , market cap weighted methodology. The Rebalancing of the index occurs semi-annually in June and December.

Investor(s) are invited to ask questions and obtain additional information, concerning the contents of this document or any other relevant matters, which shall be provided, to the extent the Investment Manager possesses such information or can acquire it without unreasonable effort or expense.

7x5pjg85n7|00004A29|AlchemyIM|ThoughtLeadership|Description

7x5pjg85n8|00004A29B796|AlchemyIM|ThoughtLeadership|Description|7C87CD34-7B2B-4E93-8ACB-46AF1A1EFE42

ear47mtete|0000025CE9F8|ThoughtLeadership|Description|917D33C8-A48D-4A22-8898-2ABE27CEDE16